TDHCA also offers a program for federal tax credits up to 2,000 a year. While this program is for first-time homebuyers, if you’re a veteran and looking to buy a home in Texas, that requirement is waived. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. This program offers 30-year fixed interest loan underwriting and down payment and closing cost assistance. compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. For instance, our repayment calculator can tell you how much. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. We offer different types of mortgage calculators that are specific to what you want to discover. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. We may receive compensation from our partners for placement of their products or services. While we are independent, the offers that appear on this site are from companies from which receives compensation. Learn more about how home loans work in our comprehensive guide to mortgages.į is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. Know how much you might pay each month on your $150,000 mortgage - including how much of your payment goes toward your interest over the principal - when shopping for a lender. Adjust the fields in the calculator below to see your mortgage amortization. With each subsequent payment, you pay more toward your principal.Įstimate your monthly loan repayments on a $150,000 mortgage at a 7.00% fixed interest with our amortization schedule over 15 and 30 years.īuying a house is among the biggest investments you’ll make. Amortization Calculator Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan.

#CALCULATE HOUSE PAYMENT FREE#

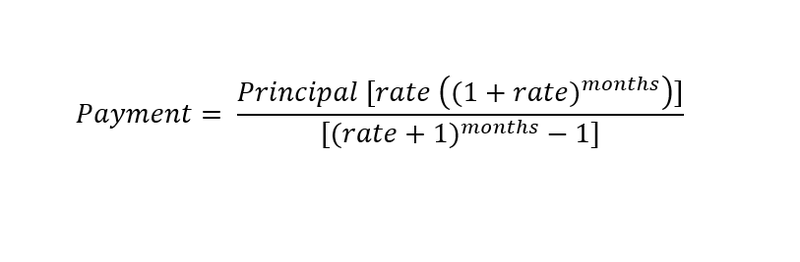

Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.Īmortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. This free refinance calculator can help you evaluate the benefits of refinancing to help you meet your financial goals such as lowering monthly payments, changing the length of your loan, cancelling your mortgage insurance, updating your loan program or reducing your interest rate. The calculator returns your estimated monthly payment, including principal and interest. Home equity loan rates are between 3.5 and 9.25 on average. When you take out a mortgage, you agree to pay the principal and interest over the loan’s life. This is the annual interest rate you’ll pay on the loan. All international money transfer services.In addition to your DTI ratio, lenders may look at your credit history, current credit score, total assets and loan-to-value (LTV) ratio before deciding to approve, deny or suspend the loan approval with contingencies.

Our debt-to-income calculator looks at the back-end ratio when estimating your DTI, because it takes into account your entire monthly debt.

Lenders often look at both ratios during the mortgage underwriting process - the step when your lender decides whether you qualify for a loan. n the number of payments over the life of the. Your lender likely lists interest rates as an annual figure, so you’ll need to divide by 12, for each month of the. Recurring monthly debt payments may include: Formula for calculating a mortgage payment. You can figure out the monthly amount by taking the annual interest rate (rate quoted) and dividing it by 12. The interest is the fee the bank charges.

#CALCULATE HOUSE PAYMENT HOW TO#

A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

0 kommentar(er)

0 kommentar(er)